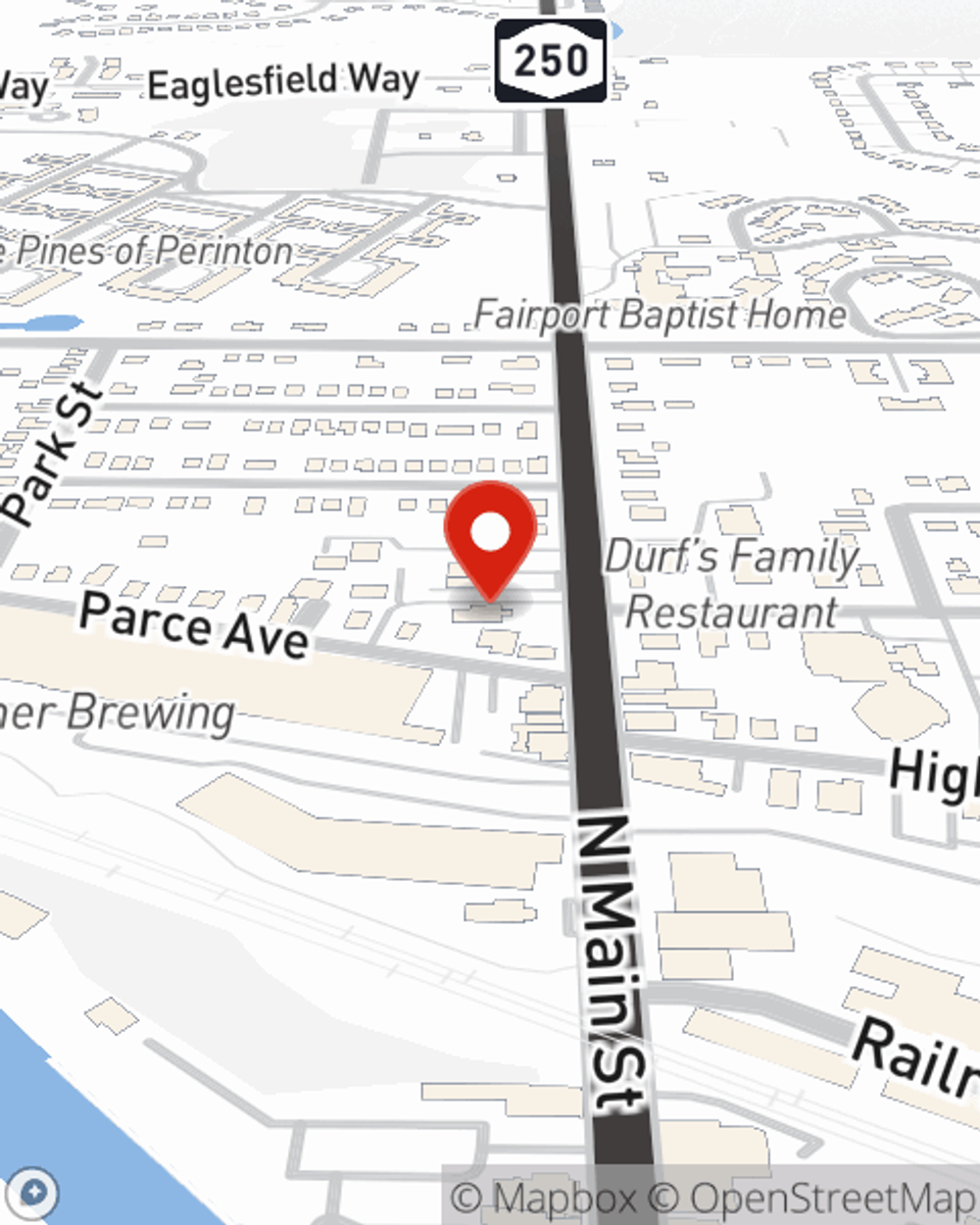

Business Insurance in and around Fairport

Get your Fairport business covered, right here!

Cover all the bases for your small business

Your Search For Reliable Small Business Insurance Ends Now.

Running a small business is hard work. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, contractors, specialized professions and more!

Get your Fairport business covered, right here!

Cover all the bases for your small business

Cover Your Business Assets

Every small business is unique and faces a different set of challenges. Whether you are growing a bicycle shop or an interpreter, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Rita Prince can help with errors and omissions liability as well as employment practices liability insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Rita Prince is here to help you discover your options. Reach out today!

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Rita Prince

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.